More than 9,000 executives, entrepreneurs and investors from around the world gathered at the largest insurtech event in Las Vegas for ITC 2022, a unique opportunity to connect, understand the industry mindset and learn where the market is headed

Over the course of three days, the insurance community came together to showcase the innovations that will transform the industry by increasing productivity, reducing costs, and, ultimately, enriching the lives of policyholders.

World’s largest insurtech event

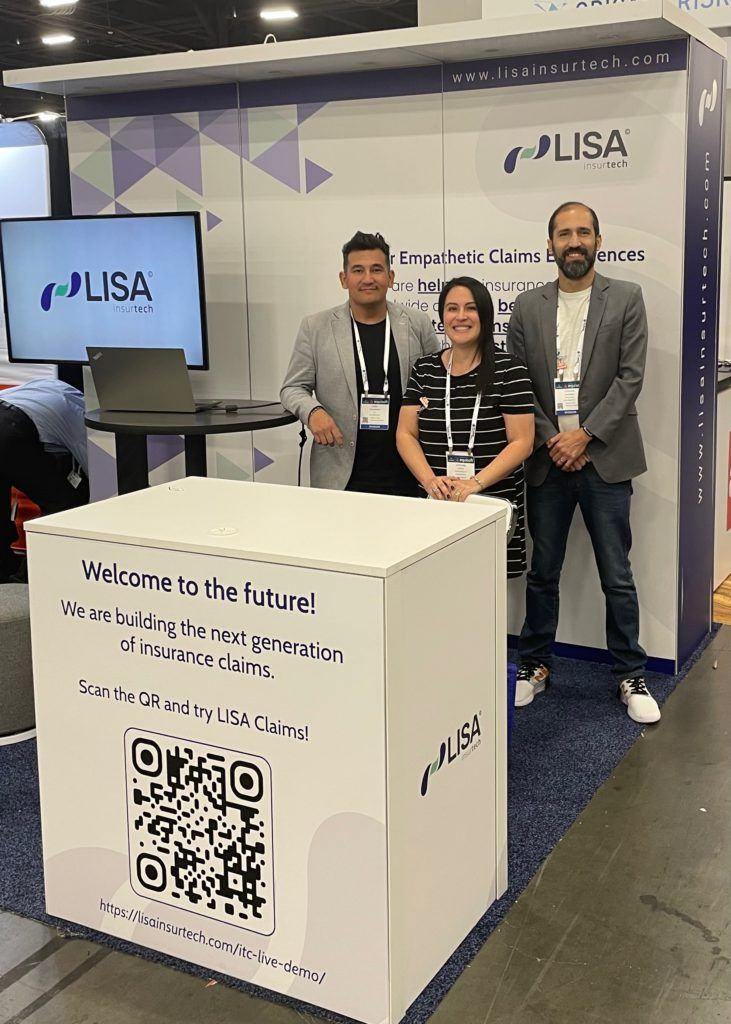

For the first time, LISA Insurtech was part of the exhibitors in this, the world’s largest insurtech event. In booth #2879, we were happy to share with many insurance decision makers how we are helping carriers worldwide deliver a better, faster, and simpler claims experience to their customers.

In addition, our team, led by Gino Volpi, CEO & Founder of LISA Insurtech, had the opportunity of exploring commercial relationships with companies from all around the world and met with investors from across the globe.

“The conference was a unique experience, jam-packed meeting with current clients, prospects, and investors! ITC is a one-of-a-kind event where you can meet and learn from so many different perspectives in the industry», said Michael Jarrett, Growth Lead of LISA Insurtech.

Main challenges

The first edition of ITC was in 2016, and the industry has definitely come a long way. Last year’s insurtech funding, which approached $15 billion, was double that of the year before. This year, though, is showing a decline in funding, forcing insurtechs to refine their strategies and focus on growing profitability.

LISA’s model is all about helping insurance optimize its efforts with artificial intelligence and cutting-edge technology.

Today we have more than 50 collaborators in different parts of the world and 19 clients in America and Europe. And this is just the beginning: “ITC2022 was full of good vibes and handshakes with future clients, investors, and colleagues. It was amazing to show what LISA is able to do in the industry with cutting-edge tech and being innovative”, said Cristian Maturana, Head of Sales of LISA Insurtech.

After sharing with the top-notch of the industry, we can’t help but feel very excited about all that is to come.

“These are amazing times for insurtechs and the insurance industries. Digital transformation is a must for carriers. They can’t keep doing what they have done for the last decade and expect different results. They need innovation and technology, but more importantly, they must understand that they must put their customers at the center of everything they do. They need to give insurers a better, faster, and easier experience”, says Gino Volpi, CEO of LISA Insurtech.

If you want to know more about how LISA Claims can help your insurance deliver a better, simpler, and faster claims experience to their customers, check out this video or schedule a demo with our team.